irs child tax credit 2021

150000 if you are. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than.

Child Tax Credit Payments Start This Week Here S How The Irs Is Trying To Make Sure The Neediest Families Don T Miss Out Cnn Politics

If you want advance payments of your 2021 child tax creditor dontthe Internal Revenue Service has two new online tools that can help.

. These changes reflect that Publication 972 Child Tax Credit has become obsolete. To get the full enhanced CTC which amounts to 3600 for children under 6 years old and 3000 for kids ages 6 to 17 years old single taxpayers must earn less than 75000. The IRS pre-paid half the total credit amount in monthly payments from.

Taxpayers should refer to Schedule 8812 Form 1040. The Child Tax Credit provides monthly payments to families. The American Rescue Plan Act ARPA of 2021 made important changes to the Child Tax Credit CTC for tax year 2021 only.

For 2021 eligible parents or guardians can receive up to 3600 for each child who. FAMILIES can grab payments of up to 3600 from the increased Child Tax Credit in 2021 until November 17 due to an IRS mistake. You can no longer view or manage your advance Child Tax Credit Payments sent to you in 2021.

Because of the COVID-19 pandemic the CTC was expanded under the American Rescue Plan of 2021. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying. 150000 for a person who.

The CTC begins to be reduced to 2000 per child if your modified AGI in 2021 exceeds. The American Rescue Plan raised the maximum Child Tax Credit in 2021 to 3600 for qualifying children under the age of 6 and to 3000 per child. For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to.

A recent report from The Treasury Inspector. 150000 if married and filing a joint return or if filing as a qualifying widow or. The advance Child Tax Credit payments.

These changes are intended to help eligible taxpayers claim the credit. Child Tax Credit Changes. You should receive the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than.

Estadounidense aumentó marcadamente el monto del Crédito Tributario por Hijos que podría recibr una familia en 2021. The credit amounts will increase for many. Not have made more than 10000 from investments.

The IRS has revised its 2021 Child Tax Credit and Advance Child Tax Credit frequently asked questions FAQs. The IRS used the information from your 2019 or 2020 tax return to estimate your eligibility for monthly Child Tax Credit payments in 2021 and send payments equal to half of the amount of. For parents of children up to age five the IRS will pay 3600 per child half as six monthly payments and half as a 2021 tax credit.

Schedule 8812 Form 1040 is now. 3600 for children ages 5 and under at the end of 2021. Nearly every family is eligible to receive the 2021 CTC this year including families that havent filed a tax return and families that dont have recent income.

That comes out to 300 per month and. Meet the income requirements which are different depending on whether you have children and are filing taxes jointly with a spouse. This means that by accepting advance child tax credit payments the amount of your refund may be reduced or the amount of tax you owe may increase according to the IRS.

The Child Tax Credit Update Portal is no longer available. 3000 for children ages 6. Under the American Rescue Plan the IRS disbursed half of the 2021 Child Tax Credit in monthly payments during the second half of 2021.

A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive.

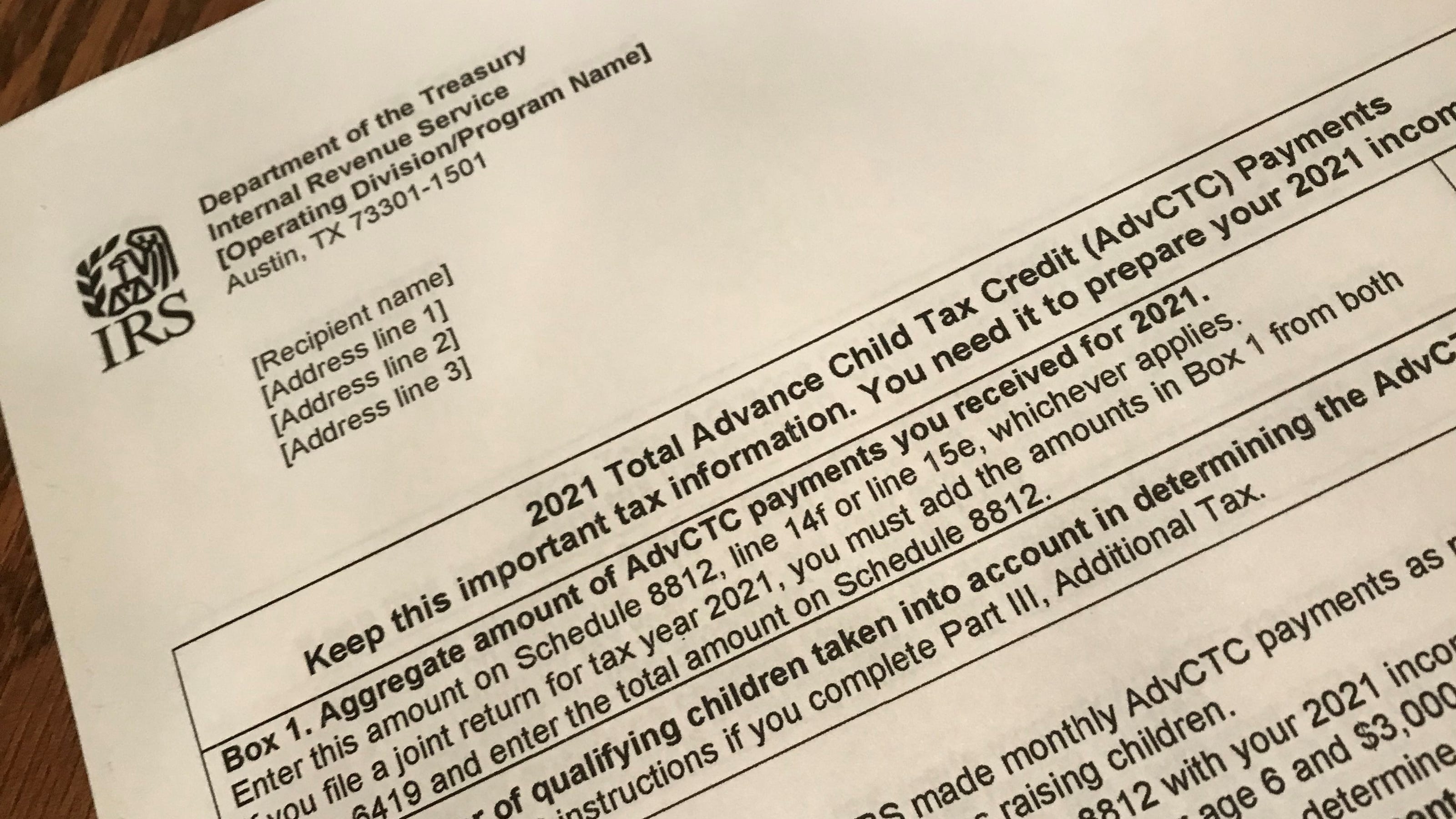

Irs Sending Letters About Child Tax Credit

Child Tax Credit Don T Throw Away This Letter Before Filing Taxes Wkrc

Millions Of Families Received Irs Letters About The Child Tax Credit

Irsnews On Twitter There Have Been Changes To The Child Tax Credit For 2021 And The Credit Amounts Will Increase For Many Taxpayers Learn More From Irs At Https T Co 535gr8fjvp Https T Co Ey7eetxkqh Twitter

2021 Child Tax Credit The Nevada Registry

Irs Sends Millions Letters About The Monthly Child Tax Credit Payments Forbes Advisor

2021 Advanced Child Tax Credit What It Means For Your Family

I Got My Refund Https Www Irs Gov Newsroom Irs Updates 2021 Child Tax Credit And Advance Child Tax Credit Payments Frequently Asked Questions Facebook

Brproud Irs Issues Warning As Next Batch Of Child Tax Credit Payments Are Set To Go Out Next Month

Child Tax Credit Advance Monthly Payments Explained Donovan

Child Tax Credit Helps Working Families Cut Child Poverty Monticello Central School District

Child Tax Credit How To Track Sep 15 Payment What To Do If Previous One Is Missing

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

First Monthly Child Tax Credit Payment Hits Bank Accounts Next Week

Will You Have To Repay The Advanced Child Tax Credit Payments

2021 Child Tax Credit Here S Who Will Get Up To 1 800 Per Child In Cash Wkrc

Irs Letter 6419 For Child Tax Credit May Have Inaccurate Information

Tas Tax Tips First Round Of Advance Child Tax Credit Letters Go To Potentially Eligible Taxpayers Payments Start July 15 Taxpayer Advocate Service

Ben Has Your Back Explaining Recent Irs Letters About The Child Tax Credit